You need certain documentation and information when filing a tax return, whether you do it yourself or hire an expert. The IRS imposes various taxes on American citizens, including federal income taxes.

Filing for returns is quite daunting, which is why business owners should consider several things during preparation. Below we discuss what you need to know before hiring a tax preparation accountant.

There Are Various Kinds of Taxes

Every American is responsible for paying taxes, but you should know the different types before preparing. The most common types include state and local taxes, federal income taxes, and property taxes.

Each of these taxes has its set of rules that businesses must adhere to or face fines and penalties. Certain taxes are based on your institution’s income, while others consider your property’s value.

There Are Different Tax Forms

Business owners must do certain things yearly to keep their business law compliant, according to Evolved, LLC. Filing returns is important, as it informs the authority about your financial situation. There are different tax forms a business owner should be familiar with to ensure they follow the right procedure.

The most common forms include 1042 and 1040, each with a specific purpose.

Document Everything and Keep Records

Business owners who do not keep good documentation and records struggle when filing taxes. Keeping accurate records is crucial, as it prevents you from guessing the amounts you owe.

Keeping detailed records is also important, as it prevents gaps in a presentation.

Tax Filing Software Is Important

The first thing you should know before using this software is to ask whether you require one. Most people assume they need this software, but tax fling is easy when done correctly. Businesses with few deductions and simple income can save time by filing taxes on paper.

However, advanced setups should consider the numerous software to save time and resources.

You Might Face Additional Taxes

Most business owners think they can evade ax because they have a low income, which is not the case. Remember, you might owe taxes even with a low income. The IRS looks for unusual situations when businesses file taxes, subjecting them to higher taxes.

Tax Issues Attract Lawsuits

Most tax issues result in lawsuits, mainly when business owners accuse the IRS of high or low tax quotations. Businesses that feel they have been taxed improperly should consult a tax lawyer to assess the situation.

Filing a lawsuit against the IRS might make them lose a suit, which is a massive financial burden.

You Can Trust the IRS.

The IRS passes laws depending on congress; for instance, they cannot audit anybody without authorization. The IRS’ trustworthiness is affected by several variables, including the political and economic climate.

Final Thoughts

Business owners can avoid missed taxes by conducting timely filing. It is advisable to keep track of the needed documents and files to make the process seamless and fast. The above article has discussed everything you need to know before filing tax returns, and more information is available online.

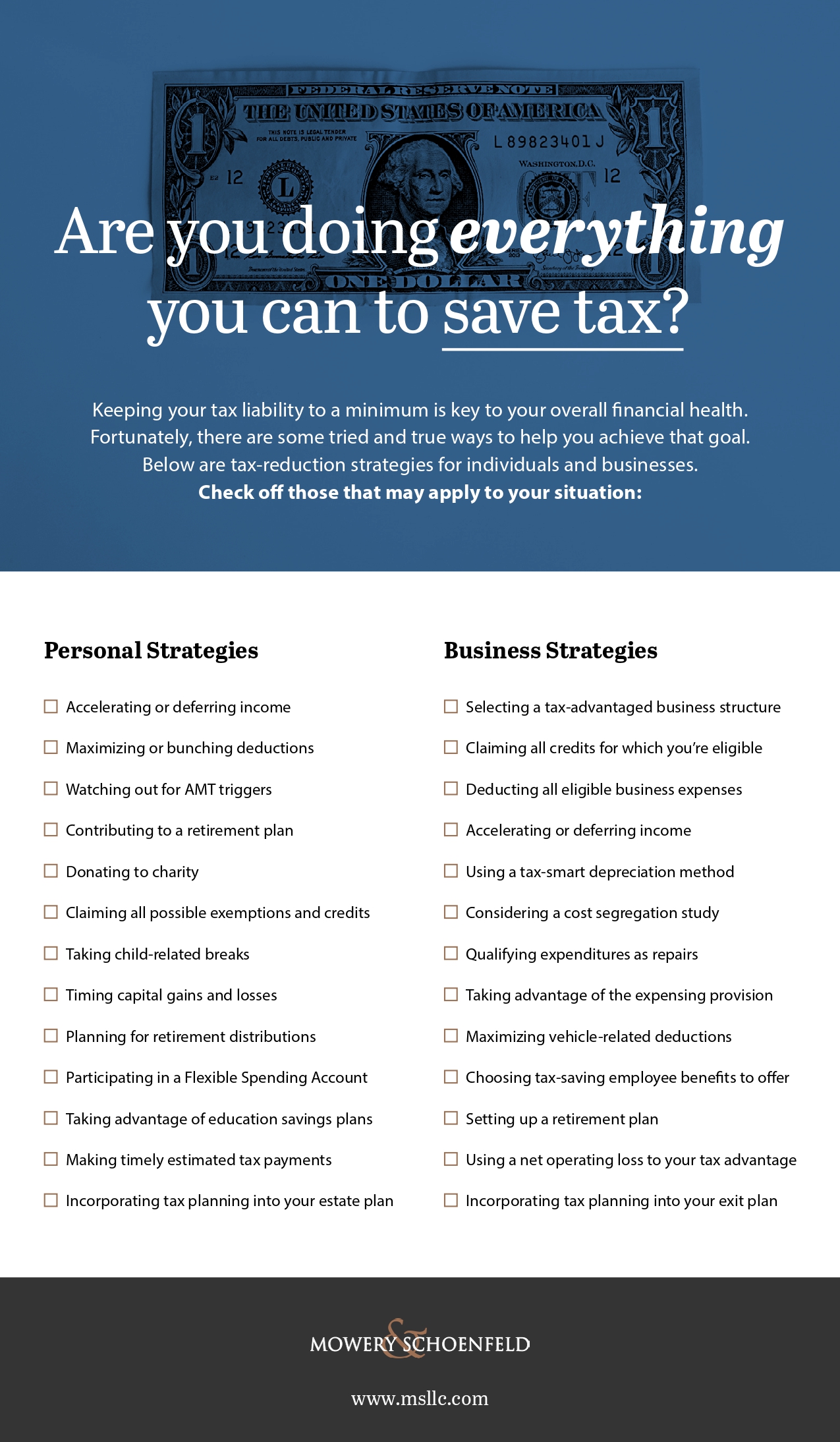

Infographic provided by Mowery & Schoenfeld, LLC., a business consulting accounting firm