Imported goods often face duties imposed by the countries into which they are being imported. Such goods cannot be released by customs authorities until duties are paid. For some importers and exporters, paying duties up front does not fit well with their plans. They would prefer to temporarily defer duties. That is where bonded warehouses come in.

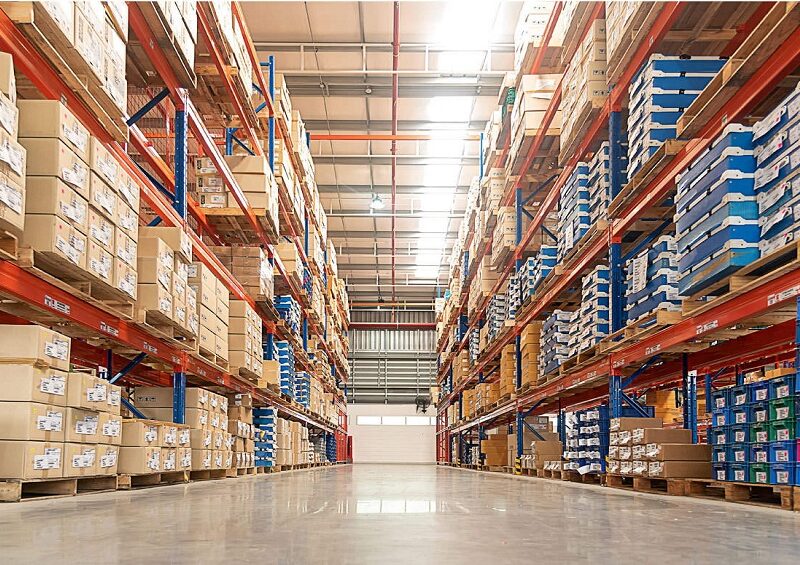

A bonded warehouse acts as an interim storage facility at which imported goods can be stored, without paying duties, for a certain amount of time. Utilizing a bonded warehouse does not completely eliminate the need to pay all applicable duties. It simply gives importers and exporters more time to make payment.

Licensed and Regulated by the Government

Bonded warehouses are not available in every country. Where they are, they are licensed and regulated by the appropriate government agencies. Bonding warehouses are the purview of U.S. Customs and Border Protection (CBP) in this country. The ability to establish a bonded warehouse is made possible by language in Title 19 of the United States code.

In Canada, bonded warehouses are licensed and regulated by the Canada Border Services Agency (CBSA). Many of the bonded warehouse rules are similar in the U.S. and Canada, but there is one key difference: there are only two types of bonded warehouse facilities under Canadian law. Here in the U.S., there are eleven different options for establishing a bonded warehouse.

Types of Bonded Warehouses

U.S. regulations allow vigied goods to be stored in a bonded warehouse for up to five years. During that time, goods can be subjected to manipulation and manufacturing operations. Ohio-based Vigilant Global Trade Services says that Federal law divides bonded warehouses into eleven classifications as follows:

Government Owned or Leased – Warehouses that only hold imported goods under order of CBP for the purposes of examination, seizure, or temporary storage until release is allowed.

Private Bonded – A private bonded warehouse is owned by an importer or seller for the exclusive purposes of storing that organization’s imports.

Public Bonded – A public bonded warehouse is utilized for the general storage of imported goods regardless of ownership.

Bonded Yards – Bonded yards are essentially bonded properties at which bulky items not suitable for indoor storage are kept.

Bonded Bins – A bonded bin is a section of a building or elevator in which imported grain is temporarily stored.

Warehouses for Manufacture – Warehouses that exist exclusively for the storage and manufacture of goods that are made primarily of imported materials.

Warehouses for Refining – Bonded warehouses where smelting or refining of imported metals is conducted prior to exportation or domestic distribution.

Warehouses for Changing Condition – Warehouses at which goods can be cleaned, sorted, repackaged, or otherwise changed by a seller prior to distribution.

Duty-Free Stores – A duty-free store selling conditionally duty-free goods in areas outside of direct CBP control are considered bonded warehouses.

Warehouses for Travel Merchandise – Warehouses that store conditionally duty-free merchandise for sale aboard aircraft.

Warehouses for G.O. – Warehouses at which General Order merchandise (merchandise that goes unclaimed by sellers for 15 days) is stored.

Global trade relies on the imposition and collection of duties to maintain a level playing field among trading partners. However, paying duties immediately upon entry isn’t always the best option for importers and exporters. Thus, bonded warehouses act as temporary storage until such time as duties are paid.

The bonded warehouse concept illustrates just how complicated imports and exports can be. It explains why companies like Vigilant exist: to help importers and exporters maintain compliance with a dizzying array of regulations that constantly change.